U.S. Considers Loosening AI Chip Ban for UAE – A Shift in Strategy

In early May 2025, the U.S. government quietly began rethinking one of its most debated tech policies — the AI chip export ban to the United Arab Emirates (UAE). While no formal announcement has been made yet, signals coming from Washington suggest a potential easing of the restriction that had placed the UAE under Tier 2 in the Biden-era framework known as the “AI Diffusion Rule.”

This isn't just about chips or trade. It's about realigning alliances, adjusting global tech strategy, and acknowledging the growing pressure from industry leaders and diplomatic partners.

What Was the Original Ban?

To understand the current shift, let’s rewind a bit.

In 2024, under the Biden administration, the U.S. imposed strict controls on the export of advanced AI chips — especially those made by Nvidia, AMD, and Intel. The idea was to prevent adversaries like China and Iran from gaining access to the high-end processors used in training large-scale AI systems, which could be repurposed for surveillance, military, or cyber warfare.

To enforce this, the administration created a tier-based framework:

- Tier 1: Full access — countries like the UK, Japan, and Australia.

- Tier 2: Restricted access — included allies like the UAE, India, Israel, and Brazil.

- Tier 3: Full ban — China, Russia, North Korea, and Iran.

Under this system, the UAE was allowed limited access to U.S. AI chips, but with tight export caps, review hurdles, and complex compliance protocols.

Why the UAE Wasn't Happy

The UAE didn’t take this lightly. As a rapidly growing player in AI research, energy tech, aerospace, and fintech, the country had been investing heavily in becoming a technological hub for the Middle East.

It partnered with major U.S. firms like Microsoft, Amazon Web Services (AWS), and Nvidia, built cutting-edge data centers in Abu Dhabi and Dubai, and even launched regional AI labs with the help of top American universities.

But despite being a strategic ally, it found itself restricted — not banned outright, but effectively slowed down.

That didn’t sit well, especially considering the country’s close military ties with the U.S. and its investments in American tech firms. For UAE leaders, the Tier 2 classification felt like a message: "We trust you — just not all the way."

What’s Changing Now

In early May 2025, reports started surfacing that the Trump administration is weighing revisions to the entire export control structure. The most likely change? Scrapping the tier system in favor of country-specific bilateral agreements.

This means that instead of applying the same rule to 120 countries under “Tier 2,” the U.S. would negotiate directly with each nation, including the UAE, based on:

- National security risk assessment

- Strategic diplomatic ties

- Internal safeguards on chip use

- Transparency and compliance systems

And according to sources familiar with the matter, UAE is near the top of the priority list for a favorable deal.

What’s Driving This Shift?

There are three main reasons behind this policy softening:

-

Industry Pressure

Big tech firms — especially Nvidia, Microsoft, and AWS — have warned that overly broad export bans are hurting business and handing opportunities to competitors like China, South Korea, and even European chipmakers.

They argue that the UAE is a valuable and trustworthy market, and that the risk of these chips being diverted is low compared to the strategic cost of alienating an ally.

-

Diplomatic Realignment

With tensions rising across Eastern Europe, Taiwan, and the Red Sea, the U.S. needs strong allies in the Middle East. The UAE has proven to be not just a military partner, but also a key counterbalance to China’s Belt and Road tech expansion in the Gulf.

Maintaining goodwill with the UAE now means more than just tech access — it could shape the future geopolitical alignment of the region.

-

Trump’s Middle East Trip

President Trump is scheduled to visit the UAE and Saudi Arabia later this month. Analysts expect the export control revision to be part of his negotiation package, signaling openness to friendlier AI cooperation — and possibly securing new commercial and security deals in return.

What Will the New Agreement Look Like?

While it’s still under discussion, the new framework is expected to:

- Allow licensed exports of high-end AI chips to UAE-based data centers

- Require on-site verification systems to ensure chips aren’t re-exported

- Implement end-use monitoring, including hardware-based geofencing (already being discussed in Congress)

- Encourage joint AI development programs between U.S. and UAE firms

It’s a more flexible and diplomatic approach, balancing national security with business interests.

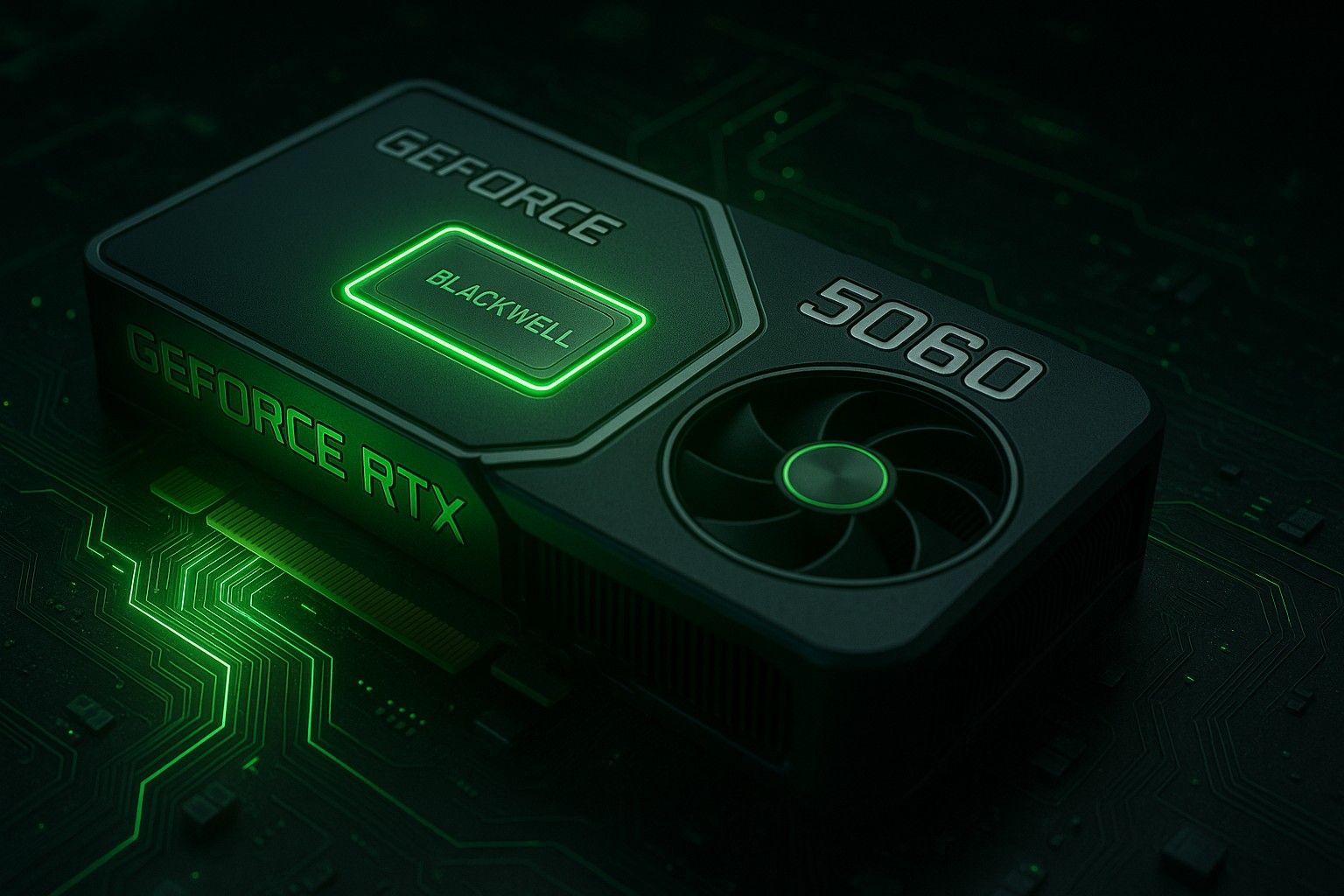

What This Means for Nvidia and the AI Race

If the UAE gets its export access expanded, Nvidia will likely be one of the biggest beneficiaries.

The country has already placed large chip orders for its new “AI Cloud City” projects, being built in partnership with Western firms. These involve:

- Natural language processing for Arabic and regional dialects

- AI-based energy management tools

- Facial recognition for secure banking and government use

- AI-powered logistics platforms for ports and airports

All of this needs hardware — lots of it. And while China and Russia are shut out, the UAE could become one of the largest AI chip customers outside the Western bloc.

Not Everyone Agrees

There’s still some hesitation in Washington about softening the restrictions.

Critics argue that even trusted partners can become unintended conduits — especially if their internal laws allow for joint ventures with Chinese or Russian firms, which could open doors to chip leakage.

Others say that easing rules for one Tier 2 country opens the floodgates — what about India, Israel, or Qatar?

But for now, the momentum appears to favor controlled openness over blanket bans.

Final Thoughts

The AI chip export debate has always been a balancing act — between security and innovation, trust and caution, policy and profit.

In early May 2025, the U.S. seems ready to acknowledge that blanket policies don’t work in a globalized, fragmented tech world. And for a key partner like the UAE, the message is shifting from “maybe” to “yes, but carefully.”

What happens next will set a precedent not just for U.S.–UAE relations, but for how America handles AI diplomacy across the world.

Because in the 21st century, AI chips aren’t just products — they’re power. And who gets them, how they’re used, and who controls their flow may shape the global order far more than we ever imagined.